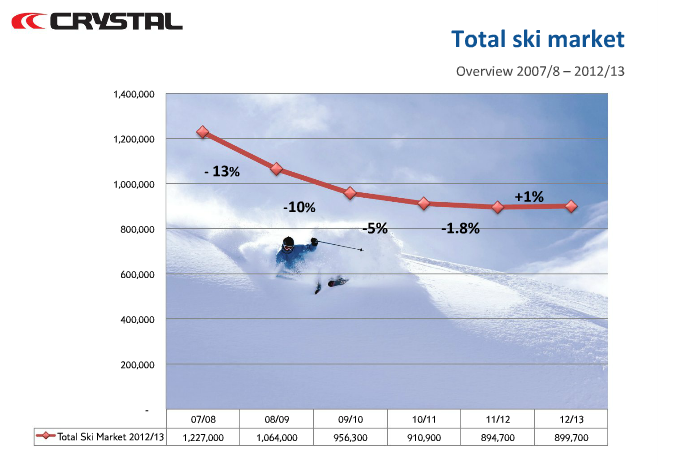

Crystal Ski today released their annual ‘Ski Industry Report’ with positive news that the overall size of the market has grown for the first time in five years.

Helped by ‘good snow at the right time’ growth was modest at 1%, however Simon Cross from Crystal Ski claimed that it showed “early signs of the green shoots of recovery.”

Overall Market

Crystal’s figures show the total market market grew from 890,000 to 899,700. The tour operator market mirrored this overall increase with a 1% growth from 510,000 passengers to 515,000. The Independent travel sector and the student sector also showed small growth.

The worrying blot in these figures was in the schools market, which fell by 7% to 83,700. This sector has now shown an 18% fall across the last four years from 101,500.

The key factor cited for this was economic, while also noting the much greater choice of trips available to school children than in the past.

Tour Operator League Table

Crystal always enjoyed producing this table. While it should be noted that they can only estimate the number of passengers that their rivals carry, their dominance is not in doubt:

- Crystal Ski (177,000, +5%)

- Inghams (89,000, +3%)

- Neilson (61,500, -16%)

- Ski Esprit (44,500, +1%)

- Thomson Ski (34,000, +2%)

- Skiworld (28,500, no change)

The standout figure was Neilson’s 16% decline, which was put down to a withdrawal away from a chalet programme to their core product. According to Crystal’s figures, this was Inghams’ first year of growth, after 4 years of decline.

TUI’s share (Crystal + Thomson) of the tour operator market was 52%, with Hotel Plan (Inghams + Esprit) taking 33%.

Schools Tour Operator League Table

- TUI (30%)

- ETG (28%)

- Interski (11%)

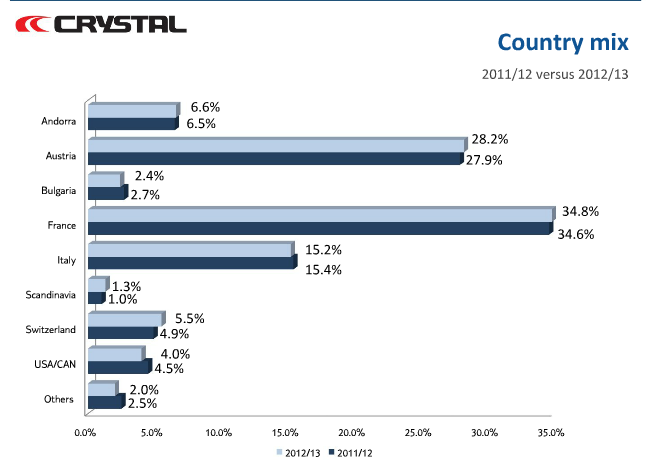

Country mix

The report showed no significant change in the share of British skiers and snowboarders going to the main countries of France, Austria, Italy and Andorra, Italy. There was a healthy recovery from 4.9% to 5.5% for Switzerland, while North America’s share fell from 4.5% to 4%.

Ski Hosting (aka Social Skiing)

After the ruling in France last season, Crystal will not offer any ‘on-slope’ skiing with customers this season. They will keep offering social skiing in 90 resorts outside of France.

“This service is highly valued by our customers,” Cross said. “I don’t think it’s particularly wise for France to disadvantage themselves in this way: you don’t want to put barriers in people’s minds.”

He did concede however that “there’s not going to be a sizeable shift (away from France), although I think it will have an effect.”

How does 2013/2014 look?

Crystal believe that the Sochi Winter Olympics won’t necessarily drive people into the market, but it will lift the profile of the sport, as will Snowsport England’s new ‘Go Ski, Go Board’ campaign.

Easter falls late (20 April) in 2014, which typically does not help sales, but there was a general feeling of optimism and that the worst of the decline we have seen is now behind us.

And I think all of us in the snowsports industry will raise a glass to that!

You can read the full report by taking this link.

By Iain Martin

1 comment

Rich Evans says:

Jul 16, 2013

Good news and all interesting stuff!

We’ve just had two great winters for snow and hopefully we’ll have another, though I wonder what effect a poor winter will have. Probably the winter after as a lot of people seem to look at the previous year when booking.

Let’s hope it is the start of a recovery regardless of the snow!